I started my software company way back in 1990 and we have done quite well. The beauty of the business is that it is adhesive. Every year we get a royalty from every customer, which means that since we started – barring some bad years when people were either cutting back or claimed they were unable to pay – the annually recurring revenues have been increasing. Many years ago we reached the point where the annual fees cover our overheads so any more software we sell is profit. Not bad for an idea that started on the back of a cigarette pack.

The fact that banks are currently paying virtually nothing for cash on deposit makes this type of business even more attractive. I get frequent approaches from investment funds, private equity firms and trade buyers asking if we are for sale. There are some big numbers being bandied about. Big to me at least. It seems the highest multiple I might expect is about nine times our profits.

A sale at that price would generate a nice lump of cash. I certainly wouldn’t have to work again. But what would I do with it? If I gave it to a private bank and told them to invest conservatively, they indicate that the best return I could currently expect is between 5% and 10%. I assume that really means 5%!

So why would I take money out of a business that I understand and control myself and which gives me an 11% return on its perceived capital value, and put it in something over which I have no control and is likely to pay only half that return? Added to which, my business is increasing in value so I’m pretty sure that I should achieve a capital gain on top of the dividend income. Finally, my business is set up to work very tax efficiently but, if I were to retire, many of these benefits could cease and make my net return even lower.

If selling doesn’t sound like a good idea, what is the alternative? I don’t want to keep working as hard as I am forever so I’m going to need a good succession plan. And that means employees who are committed to the business over the long term.

Over the years I’ve tried different ways to keep the staff incentivised. When I started the business, we simply paid a salary that was reviewed periodically according to performance. That seemed to work well for a time. When we looked at bonus schemes we could see as many disadvantages as advantages. Staff might be tempted to sell customers the wrong product just to boost their bonus and, besides, bonuses don’t always account for the costs of a sale. They also could create a culture where everyone is competing rather than cooperating.

In the end it became clear that we could not attract or retain good staff without a bonus scheme so we created one. It seems to have worked well and be relatively benign.

We also gave key staff share options. Unfortunately this corresponded with a downturn so the options became worthless and didn’t seem to spur anybody to greater effort. Later we were put under pressure to revise the option targets to match the actual results. That seemed pointless so we declined. The whole scheme became a damp squib.

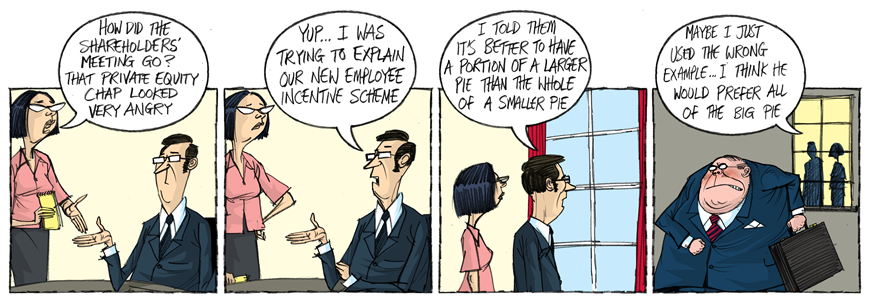

So now we have devised a long-term incentive plan. It works by giving key staff “virtual share” in the company equal to 50% of any increase in the value of the company. The allocated shares are held by trustees so we don’t have to deal with multiple shareholders and we can take the “shares” back if an employee leaves or stops performing. In this way it should work equally well for employees, by giving them a stake in the ongoing success of the company, and shareholders, because it is better to have a portion of a larger pie than the whole of a smaller pie. I’m pleased with the results and so are the employees so objective achieved.