Considering Trusts in Pre-IPO planning

An initial public offering (IPO) is a watershed event for business owners that will have significant implications for their personal wealth. IPOs allow companies to attract capital to fund organic growth or acquisitive expansion and are also a popular exit strategy for company founders and early investors. Creating a public market for a company’s shares at fair price generates liquidity and provides an opportunity to sell the shares promptly with minimal transactional costs.

Hong Kong has ranked as the world’s top IPO venue in seven of the last 12 years. And, despite recent global market volatility, the primary market continues to take a leading position in the world’s IPO fundraising league tables. In 2020 a total of 154 companies listed on the Hong Kong Stock Exchange (HKEX), raising HK$398 billion – the highest amount raised in a single year since 2010 – compared to 164 IPOs raising approximately HK$315 billion in 2019.

Going public is a major challenge for any company and there are many decisions that will need to be taken prior to an IPO. While founders are generally focused on optimising performance, ensuring they meet listing requirements and promoting their business, there is one key risk factor that is often overlooked during pre-IPO planning – their personal situation.

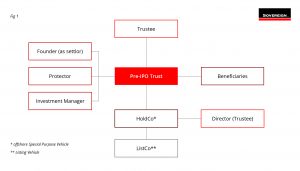

It is critical for founders to establish an estate plan early the pre-IPO planning phase because the opportunities will generally diminish as a deal moves toward the closing date. Many opt to settle their shares into trust prior to an IPO.

A pre-IPO trust provides a secure, arms-length structure in which owners can place the shares of an as yet unlisted company, at a time when their potential value is at its most volatile. It can greatly reduce the risk of an IPO being damaged or derailed by commercial or legal disputes, or by personal issues such as divorce, injury or illness, even death.

Chinese video streaming service Tudou, for example, had to delay its planned IPO in 2010, after Yang Lei, the former wife of chief executive Gary Wang, filed a lawsuit against him. During the delay, Tudou’s competitor Youku raised US$203 million on the New York Stock Exchange, valuing the company at US$3.3 billion. Tudou eventually went public in 2011 with a valuation of US$822 million.2

After an IPO, the same trust can then be used for safeguarding business interests, planning family succession and achieving tax efficiencies.

An IPO further presents companies and their founders with a golden opportunity to reward and lock-in any talent that has been critical to their success. As a part of pre- or post-IPO planning, many firms choose to establish employee stock option plans (ESOPs) with a view to incentivising employees by offering them shares in the business at a favourable price.

Advantages of a pre-IPO trust

Pre-IPO structure for employee stock option plans (ESOPs)

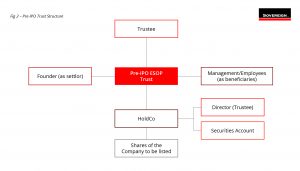

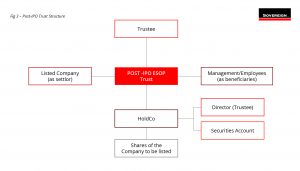

Employee stock option plans (ESOPs), often known as equity incentive plans, can be established as a way to motivate key employees in the critical lead up to an IPO and to retain and attract employees in the period after an IPO.

A portion of the ListCo shares, separate from those of the founder and early investors, can be placed into trust for certain employees with the intention that the shares, share options or proceeds of sale of the shares can be distributed to those employees provided that satisfy the criteria set out in the trust deed and rules that govern the trust.

The award of company stock to employees means that the employees have a vested interest in the success of the company and ESOPs that align the interests of management with those of minority shareholders are becoming more common. Some 52% of 337 Chinese companies listed in the US or Hong Kong between January 2016 and July 2019 operated equity incentive schemes, according to a PWC survey.

Such plans are considered to be an effective means for companies to improve corporate governance and performance and their employees’ loyalty, especially for start-up companies with limited capital in their early stage. Offering employees shares in place of cash bonuses can have a significant impact on preserving cash flow.

China-based short-video platform Kuaishou Technology, for example, established a pre-IPO ESOP Plan involving over 1,000 employees in December 2014 for “the purpose of attracting, motivating, retaining and rewarding certain employees, directors and other eligible persons”.

The pre-IPO ESOP Plan was to be valid and effective for 10 years from the approval of the board of directors and the maximum number of shares to be issued was set at 312,661,648 ordinary shares, later increased to 711,946,697. The majority of share options had graded vesting terms that would vest from the grant date over four years on condition that employees remained in service, but with no performance requirements.

The ESOP shares were held in trust with the employees (participants) as beneficiaries and the options could be exercised at any time after the IPO, for a maximum period of 10 years, provided that they had vested and were subject to the terms of the award agreement. Kuaishou’s shareprice jumped 161% after its US$5.4 billion IPO in February 2021. The shares closed at HK$300, compared with the IPO price of HK$115, valuing the firm at US$159 billion.

The diagrams below illustrate a typical Pre-IPO and Post-IPO ESOP Trust Structure:

There are two principal categories of ESOP:

- Share Award Scheme – On the vesting date, shares are gifted or sold (at a below market price) to employees by the company, subject to certain vesting restrictions.

- Share Option Scheme – Employees have the right, but not the obligation, to buy shares in the company at an agreed exercise price on the vesting date. The subscription price for the share options is set at the discount to the market price and, if the employee exercises the right converted the options into shares, the employee will become a shareholder on the vesting date.

Payment of tax is dependent on tax residency and therefore, as a general rule, it is always a good idea to seek independent tax advice. Employees in the PRC who are involved in an ESOP that is not based in the PRC are required to register with the State Administration for Foreign Exchange before they can legally convert Chinese Yuan into foreign currency and remit out of China to purchase shares.

ESOP Advisory Committee

The Advisory Committee plays a significant role in an ESOP Trust. It gives written directions, always in accordance always with the trust deed and rules, to the trustee in respect of trust management matters such as the purchase or sale of shares, asset distributions to beneficiaries and the addition or removal of beneficiaries. The committee usually consists of staff appointed by the company, but it is not recommended for senior executives to be appointed to avoid unnecessary information disclosure.

Regulatory Compliance

All companies offering an ESOP must comply with the HKEX listing rules. Additionally, state-owned companies must further comply with specific rules for certain types of enterprises, such as the ‘Provisional Measures for State-owned Scientific and Technological Enterprises on Equity and Dividend Incentives’ or the ‘Notice on Pilot Work on Incentives to Dividend Rights in Some Central Enterprises’.

Professional advice

The establishment and administration of Pre-IPO trusts and ESOPs can be extremely complex. In Hong Kong, professional trustees are required to be licensed under the Trustee Ordinance (Cap. 29) to provide trustee services to IPO trusts and ESOPs.

Failure to consider and comply with any of the requirements – legal, financial or regulatory – may result in penalties and adverse consequences for the parties involved. It is therefore critical for the founder and the major shareholders to work closely with a licensed Trust & Corporate Services Provider (TCSP), with the support of qualified accounting, legal and tax professionals, to ensure initial and ongoing compliance.

Please contact us if you have any questions or queries and your local representative will be in touch with you as soon as possible.