About the Isle of Man

The Isle of Man is a tax-efficient, responsible and dynamic international business centre, that is built on a model of political stability, effective regulation and transparency. As a ‘whitelist’ jurisdiction, it is a sought-after destination for company formation and establishing trusts and foundations. Close proximity to the UK and good connectivity makes it highly accessible to global clients, and it offers the modern infrastructure, range of investment structures, financial institutions and professional advisers to service the most sophisticated clients.

Key Benefits

- 0% is the standard rate of corporation tax for all resident and non-resident Isle of Man companies.

- The top rate of personal income tax is 22%, capped at a maximum of £220,000 per year.

- There is no capital gains tax, inheritance tax, wealth tax or stamp duty, and no withholding tax on dividends.

- No tax is levied on trusts with non-Isle of Man resident settlors or beneficiaries.

- Part of UK VAT area, which can be highly beneficial for clients with UK tax points or for businesses and individuals with economic activities in the EU.

- Legal system based on English common law and closely follows English Court precedents.

- Part of the UK banking system, enabling same-day processing of inbound and outbound payments at nominal cost.

- Provides for a wide range of traditional and non-traditional corporate vehicles.

- At the forefront of best practice in trusts and has also legislated for foundations as an alternative wealth management structure.

- OECD ‘whitelisted’ as complying with global standard for tax co-operation and exchange of information.

- Expanding network of Double Taxation Agreements (DTAs).

- Excellent banking, legal and accounting services capacity, with highly competitive costs

- UK time zone and postal services allow for next day delivery of mail to/from the UK.

Why choose Sovereign Isle of Man?

Sovereign Isle of Man is dedicated to delivering integrated advice, products and services to internationally mobile businesses and people with sophisticated and often complex needs. It is our fiduciary duty to act in good faith and in the best interests of the clients we represent. As well as forming and managing structures, we provide the necessary on-going administrative support, from full back-office solutions to assistance with tax and regulatory compliance. Sovereign also has the capacity to provide fully managed structures with local directors and banking services. This ensures compliance and provides the necessary economic substance for effective residence.

Licensed by the Isle of Man Financial Services Authority

Comprehensive Corporate Solutions

Isle of Man entities can be used for all types of business – holding and trading companies, estate and succession planning, family office, funds, local and international property holding, and insurance. We assist clients to set up structures, supply registered office and company secretarial services, and then provide ongoing administrative support to ensure your business remains operationally efficient and legally compliant. This can include accountancy, pensions, obtaining local licences and permits, executive relocation and specialist tax advice.

Fiduciary and Private Client Solutions

The uses of Isle of Man Trusts and Foundations include wealth management and asset protection, succession planning, provision for vulnerable beneficiaries, philanthropic and charitable purposes, as well as tax planning and holding vehicles for commercial assets. After setting up these structures, Sovereign Isle of Man can provide full administrative services. This can include the management and control of a variety of assets, from investments to real assets such as property, as well as the preparation of financial statements, accounts, the completion and filing of tax returns and the opening and maintaining of bank accounts.

Retirement Planning

An established centre of excellence for international retirement benefit plans, the Isle of Man specialises in all aspects of international pension planning, from large multinationals to individual clients. It also offers a tax neutral environment in which the assets of a scheme can grow free of taxation and, on drawdown, are paid to scheme members gross.

Sovereign Pensions offers a full range of multi-member retirement benefit solutions from the Isle of Man, including two Qualifying Recognised Overseas Pension Scheme (QROPS), a Qualifying Non-UK Pension Schemes (QNUPS).

The Island’s pensions regulations are robust but highly flexible, allowing corporate clients the freedom to tailor international retirement solutions to the diverse demands of their international operations. All plans can be tailored to fulfil the objectives of the scheme sponsors and members.

Sovereign People

Sovereign Isle of Man places an emphasis on strong client relationships, technical excellence and a commitment to delivering high-quality service. The office is led by highly experienced and qualified professionals with a significant depth of knowledge and expertise in their respective fields, often gained through years of practical application and ongoing learning. The senior team is also committed to supporting the growth and development of their team throughout their professional qualification journey.

Sovereign Insights: stay updated on the Isle of Man

The international tax, legal and regulatory landscape is constantly changing. It is our duty to actively seek out and process relevant information to ensure compliance and reduce risk. Explore our latest news, blogs and posts to stay updated on developments and gain the latest perspectives on the business, legal and wider issues that matter. You can also subscribe to our newsletter.

Sovereign Knowledge Hub

Sovereign is focused on supporting clients by ensuring they have the knowledge, information and resources they need to stay informed and make confident decisions. From briefings, information sheets and case studies, to videos and Webinars, our Knowledge Hub contains the practical resources to give clients the latest perspectives on the business, legal and wider issues that matter. Browse the library.

Sovereign – Licences and professional affiliations

Sovereign Trust (Isle of Man) Limited is licensed and regulated by the Isle of Man Financial Services Authority (IoMFSA) to provide Corporate Services, Trust Services and Management or Administration to Licence holders. It is also a member of the Association of Corporate Services Providers (ACSP), the trade association for licensed fiduciary service providers on the Isle of Man, and many staff are members of global professional bodies such as the Society of Trust and Estate Practitioners (STEP) and the International Tax Planning Association (ITPA). Sovereign Pensions Limited is licensed and regulated by IoMFSA as a Professional Schemes Administrator.

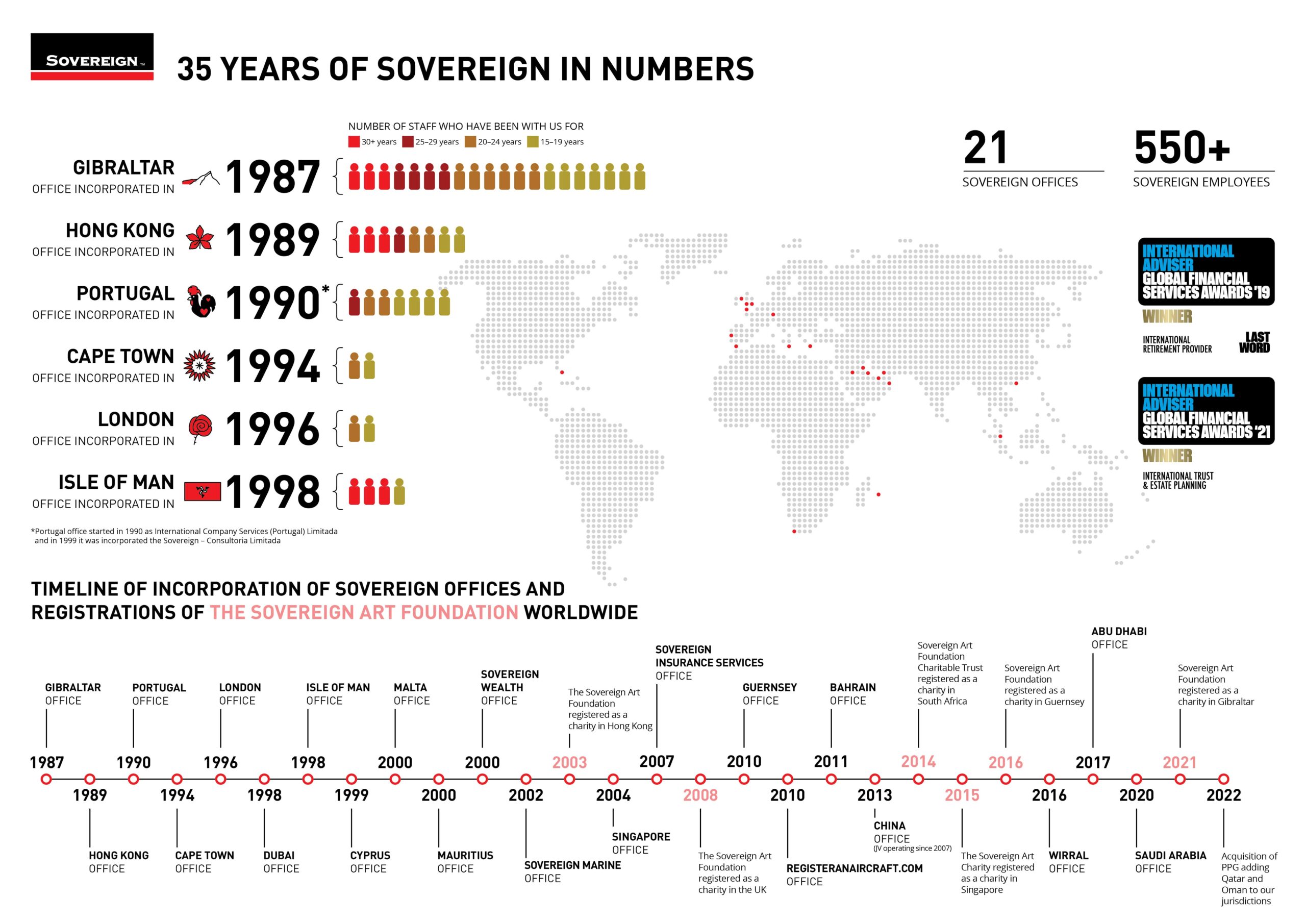

Sovereign’s Global Network

Please contact us if you have any questions or queries and your local representative will be in touch with you as soon as possible.