Sovereign Man – April 2015

By Simon Garveen

Simon Garveen is a typical Sovereign client. Now in his mid-40s, Simon is a successful entrepreneur who floated a software business on the AIM in 2005 and sold out his remaining stake the following year. He is now an investor in multiple private businesses worldwide, with a current focus on China, Africa and the Middle East. His business interests range widely, from software and manufacturing through to food and wine production, property, hotels and leisure. He also supports a number of charitable concerns. He calls Hong Kong home but travels widely and has houses in the UK and Portugal. He holds UK and St Kitts’ citizenship, is divorced from his first wife, with whom he has three children aged 12 to 19 – all being expensively educated in the UK and US. He remarried in 2008 and has two further children under the age of six. He enjoys travel and sailing, and collects art, antiquities, wine and now classic cars. He supports his elderly parents and to some degree his other young relatives. Much of his wealth is tied up in physical assets or in long term or active investments so he doesn’t generally have ready access to much cash. His life could be very complicated but, with expert help, he makes it look easy.

No 1. Not-so-dodgy motors

One of my private equity investments came good the other day – which is nice because plenty don’t. My rule is to invest in 10 – five will likely not come to much, three will wash their face and then I hope other two will make it all worthwhile. This one did really well so I’ve got a decent chunk of change in the bank account for the first time in a while and have been thinking about what to do with it.

Stock markets stress me out. However long term the investment strategy, I find it impossible not to check the indexes regularly and it’s no fun if they are falling. Besides, as they keep reminding me, highly paid (they say “adequately remunerated”) investment managers are looking after my portfolio – so it’s alternative asset classes that I should be focusing on. My wine cellar is full and I have plenty of art on my walls, so my thoughts have turned to classic cars.

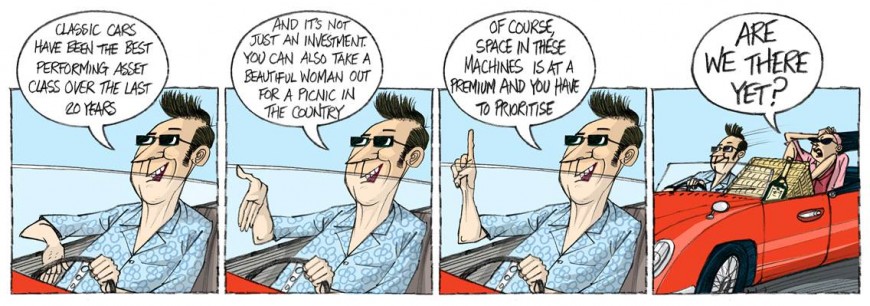

According to several recent surveys, classic cars have been the best performing asset class over the last 20 years. Genuine classics do fit the investment model: they don’t make them any more; they didn’t make many to start with; there is usually a significant attrition rate from accident, theft or neglect; and they enjoy a substantial fan base. And what could be better than having a “boy’s toy” that can be fully justified as an investment.

After some fairly extensive research I have drawn up a hit list of relatively low priced vehicles that experts are tipping to increase dramatically in value. The market seems to be on fire and they are such beautiful things that, even if they don’t increase in value, I get to enjoy them and drive them. The top end of the market is looking very frothy and anyway I can’t afford the very rarest models, so I’ve settled on trying to find a Ferrari 575 Maranello. These seem to have been priced at £60K for ages but now seem to be increasing in value. I’m hoping that will continue. Although I plan to keep my cars in the UK, I think a left hand drive model (LHD) might be preferable. I don’t find them difficult to drive and the market for LHD is so much bigger.

The best option is to look for a low mileage example in mint condition with a full service history. The market seems quite imperfect. Import duties, VAT, tax, condition, mileage, the number originally manufactured and estimated numbers left all have a big bearing on price. As do the profit expectations of dealers. After some time I tracked down a few cars which fit my criteria in Dubai – where they don’t seem to value classic cars as much as they do brand new flashy ones. On top of that the climate means no rust and they have rarely done many miles.

Of course if you’re buying at a distance it is absolutely crucial to have a local expert you can trust, who can vet the car and ensure that money is handed over only in return for legal title. Luckily I had someone recommended to me who was qualified to examine the car and documentation and then negotiate the price – but there are many scamsters in this business so great care is needed. More on that another time.

It seems that to get it back to the UK, I’ll have to stump up for shipping, 5% import duty and 20% VAT. Even after factoring in all these costs I think I have ended up with a bargain. Irrespective, there isn’t too much wrong with having a beautiful Ferrari parked in my UK garage. I’m told it should be owned through a structure in order to avoid potential liability to 40% UK inheritance tax. I’ve also been recommended an insurance policy that treats my car like a work of art, which substantially cuts the usual cost. In fact, it should cost less to insure than my existing cars.

Acquisitions can be addictive and I may already be turning into a ‘petrol head’. I am now hunting for 1960s open top Italian sports cars by Alfa Romeo and Lancia. These are lovely things from a time when they made things properly and they didn’t disintegrate after their first wet outing in the UK. After all, what is more enjoyable – a BP share certificate or a Ferrari? Let me think about that for just a millisecond …